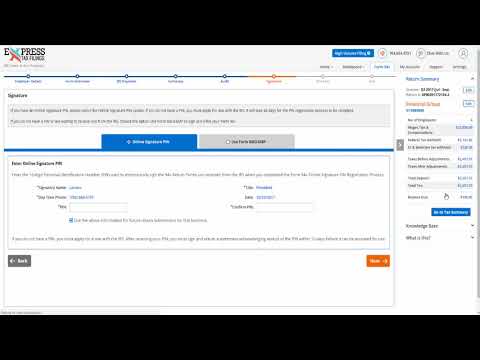

So now that you know you can e-file form 941 with Express Tax Filings, would you like to learn how to do so? Step one, log into your Express Tax Filings account and click on form 941 under "Start New Forms". If you just created your account, you'll bypass this step because you'll automatically be taken to the list of available forms. To get started, next, it's time to fill in those employer details. You can either select from an existing employer in your account or add a new one. In addition to the details shown, you'll also provide the employer address, contact details, and signing authority. Now, it's time to choose a tax year and filing order. As you can see, you can choose between the current tax year or the most recent previous one. So select the year from the drop-down menu, then click the "Start Filing" button in the quarter that corresponds with the quarter for which you need to file the 941 form. Next, you'll fill in a series of sections and answer questions to provide your wage and tax information for the quarter. Don't worry, in these sections, Express Tax Filings won't let you keep moving forward if you've entered something wrong. You may even find that our streamlined process is simpler and more straightforward than filling out paper forms. Now that you've entered your information to complete form 941, you'll have the option to pay any taxes currently due to the IRS before your deadline. You'll probably notice that there's a summary of the information you've entered so far on the right side of your screen. You can click the "edit" button in this section to go back and make changes, or click the "go to tax summary" button to view more details about...

Award-winning PDF software

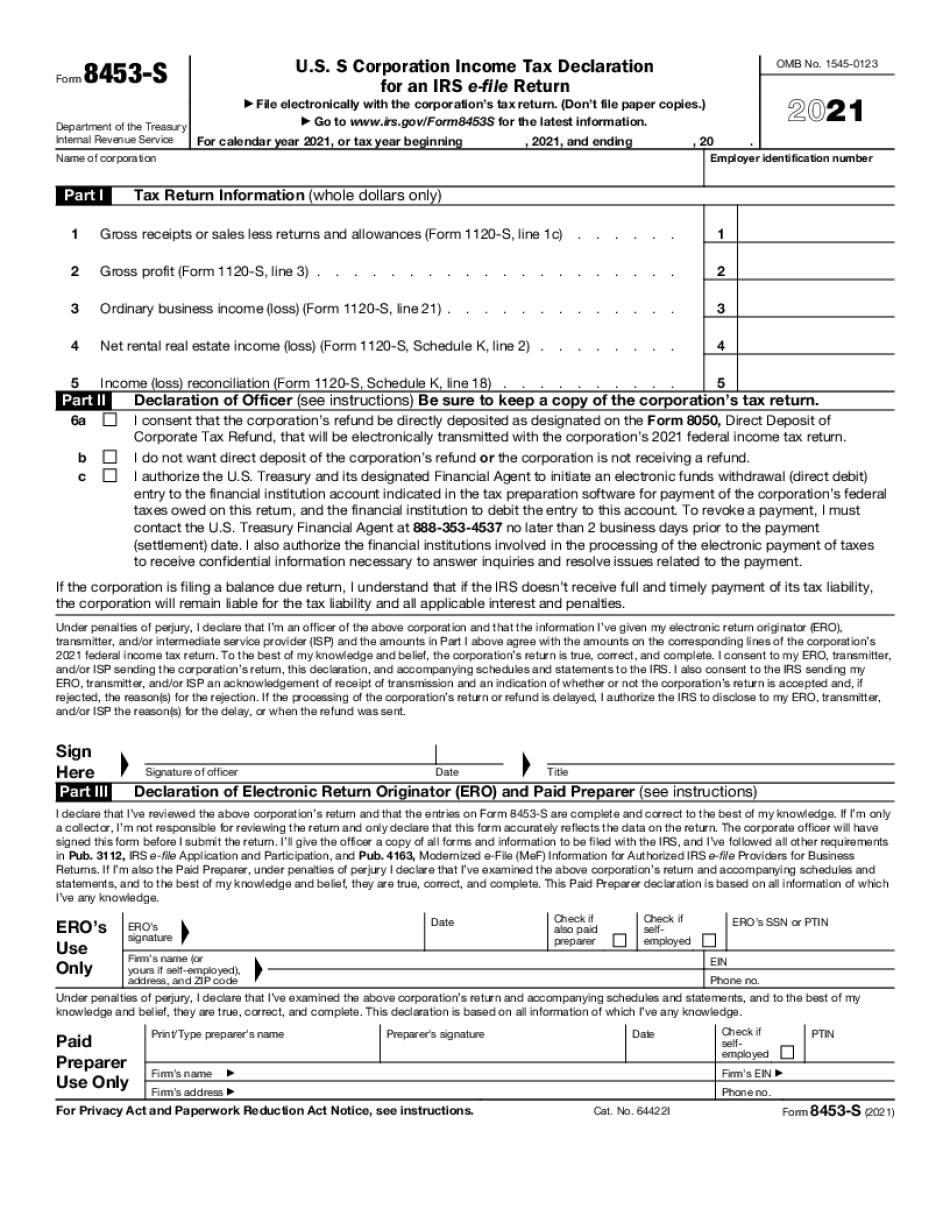

Video instructions and help with filling out and completing Are Form 8453 S Amend