Divide this text into sentences and correct mistakes: 1. Welcome to Express Tax Filings, the most secure way to complete quarterly taxes online. 2. When you file Form 941, the IRS requires a valid electronic signature as an extra line of defense. 3. This ensures that the person filing your business taxes is you, or at least someone you have authorized to file for you. 4. In order to complete the e-filed Form 941, you must sign it with an online signature PIN assigned by the IRS. 5. Thanks to Express Tax Filings, you can request an online signature PIN for free. 6. When you reach the Form 941 signature page, select the online signature PIN option. 7. Then, enter the 10-digit PIN to electronically sign the 941. 8. If you do not have an online signature PIN, you must apply for one with the IRS by clicking "Request a New PIN." 9. Review the employer's EIN and address details to confirm that the pin is for the correct entity. 10. Enter the signing authority's contact details before requesting to send it in. 11. After you request a new PIN, the IRS will mail it to your address. 12. Upon receiving it, you must sign and return a statement acknowledging receipt of the PIN within 10 days. 13. This step is necessary before the PIN can be activated for use. 14. It will take 45 days for the PIN registration process to complete. 15. If you prefer, you can use the alternate option of signing Form 8453-EMP and transmitting the return to the IRS. 16. To get started on your quarterly taxes, visit Express Tax Filing's website at expresstaxfiling.com. 17. This video is brought to you by Express Tax Filings, the most efficient online tax preparation and tax filing software.

Award-winning PDF software

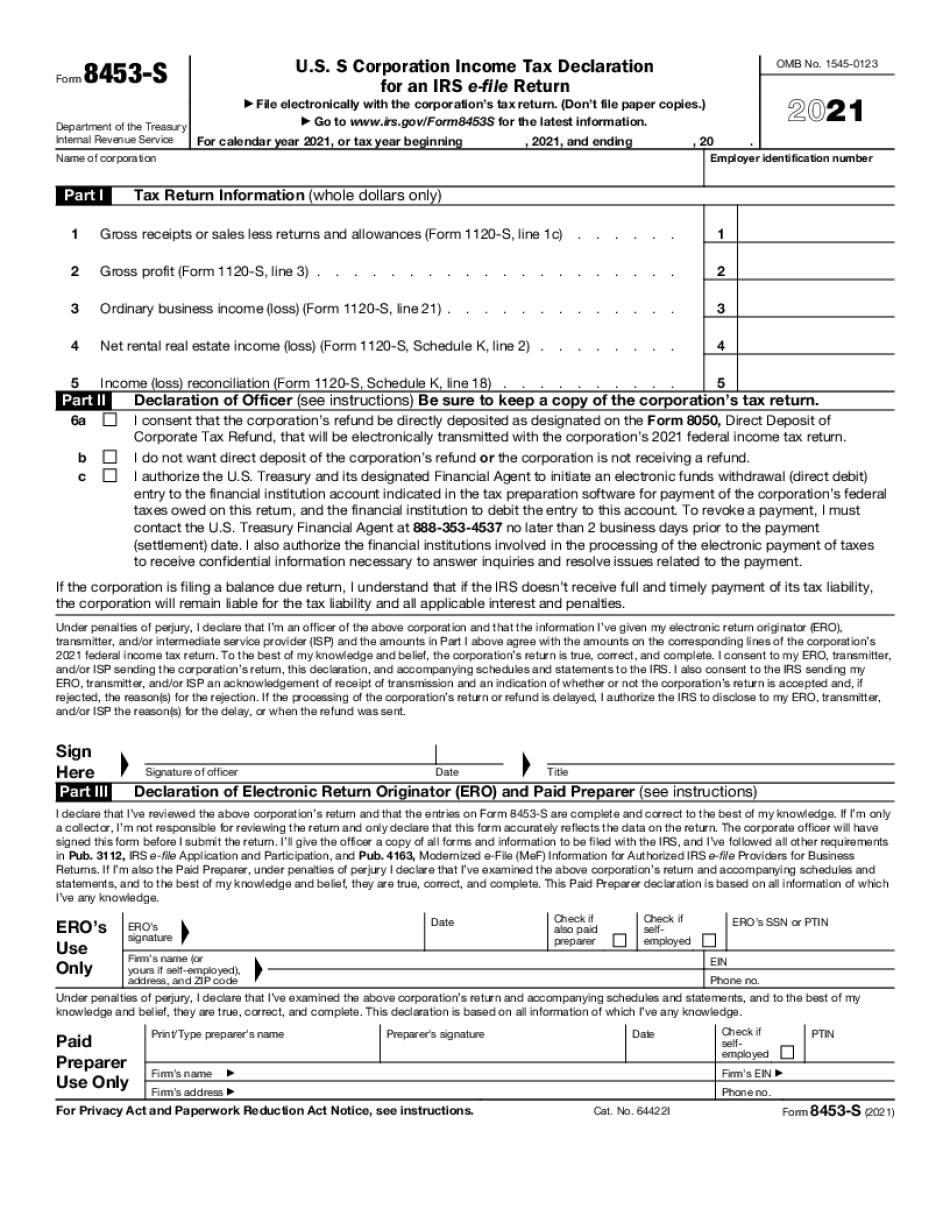

Video instructions and help with filling out and completing Fill Form 8453 S Filers