Divide this text into sentences and correct mistakes: 1. So what are the main types of business entities that we're going to discuss in this lecture series? 2. Okay well, the most common form of state-recognized business entities are, and I begin with the sole proprietorship. 3. It's not necessarily an entity, but it is a recognized form of doing business, so it is the default, the backdrop for how every other entity is identified or the characteristics are identified in contrast to how it would be deemed as a sole proprietorship. 4. Okay, so the sole proprietorship, one individual carrying on a commercial activity. 5. A general partnership is again, some argue that the general partnership is not a business entity status, but it is commonly recognized as such in most arenas. 6. But again, it's two or more individuals carrying on a commercial activity for profit or loss. 7. Then you have your state-recognized filed business entities, right? That is, you have to file some forms and receive certification of your existence under state law. 8. To start with, the limited partnership, okay, this is a special form of partnership where you have at least one general partner and at least one limited partner. 9. And again, the requirements are that you file with a state entity for recognition. 10. Next, a limited liability partnership, this is generally reserved for professional practitioners but it provides for a level of limited personal liability for each of the partners from liability for actions of the other partners. 11. Okay, so it generally accounting engineering law medical design architecture those type of firms are canola that can only be limited liability partnerships. 12. But the limited liability status of it is also accompanied by a requirement to have some level of professional insurance...

Award-winning PDF software

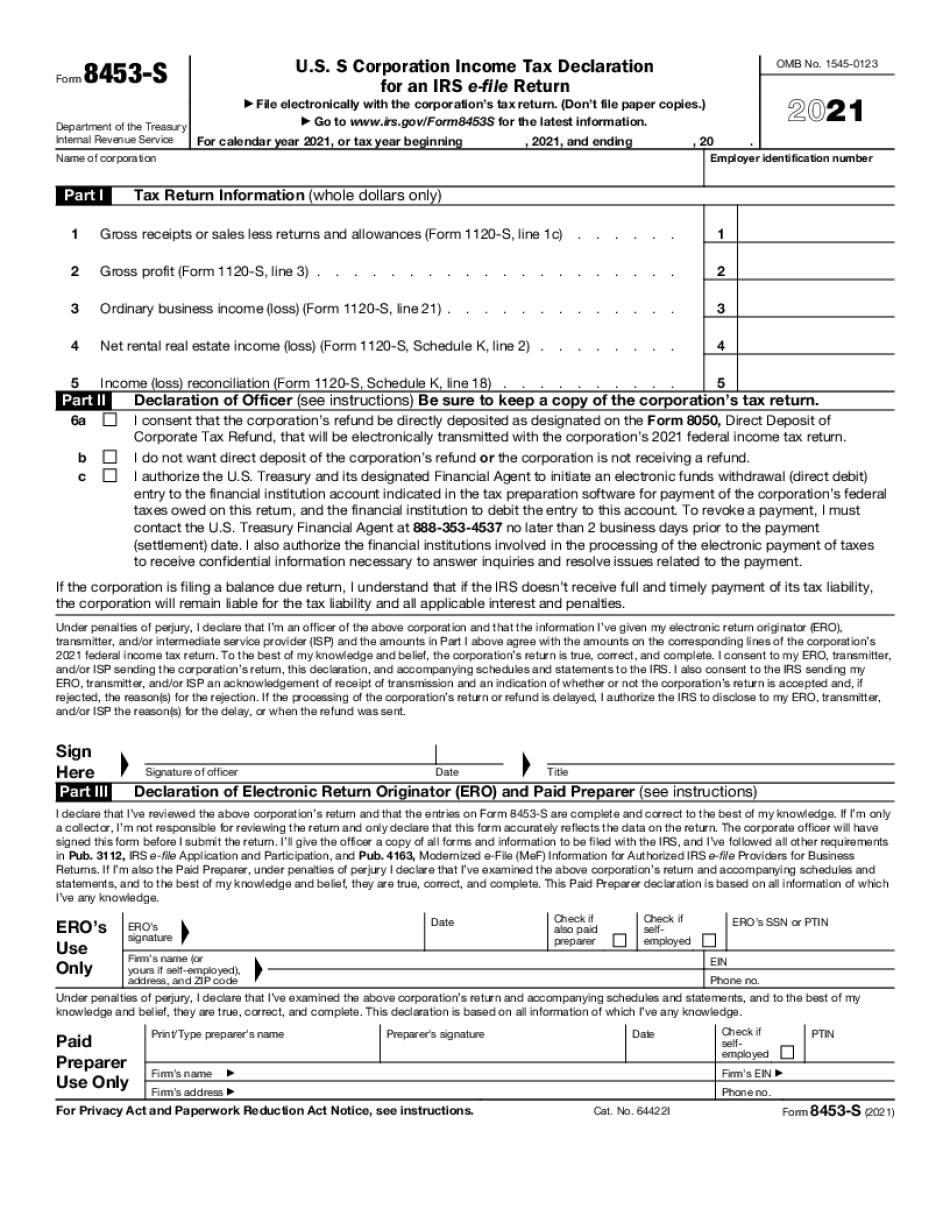

Video instructions and help with filling out and completing What Form 8453 S Entities