For this video, I want to cover the IRS Form 8453, which is a transmittal form for certain types of documents that you might need to submit with your 1040. So, I've got one slide in front of us here covering kind of what this form is and when you may need it, with an example. Then, we'll go through a sample 8453 and how to submit it to the IRS. So, what is this form? This is a form where you have to paper file additional documents to the IRS, and it works as kind of a cover sheet. Alright, so when the taxpayer electronically files their 1040, there might be cases where they have to provide additional information to the IRS or they have to file a form with their 1040 that's not supported for e-filing purposes. Believe it or not, there are actual forms that the IRS has that are actually part of tax return prep software, but the software itself or the IRS doesn't accept it for e-filing purposes. So, for example, the one we're going to look at here is the 8332. The 8332 is a release of an exemption by a custodial parent so the non-custodial parent can claim the child as a dependent. However, this form generally cannot be e-filed, and even if you wanted to print it off, sign it, and attach it as a PDF, you can't do it. In order to submit this to the IRS, you have to electronically file your 1040 and then paper file the 8332 with the 8453. Now, the 8453 can be prepared with the return, but you should only be submitting it after you've gotten an e-file confirmation that the return was accepted. So, file the return within a few business days, get an e-file confirmation and...

Award-winning PDF software

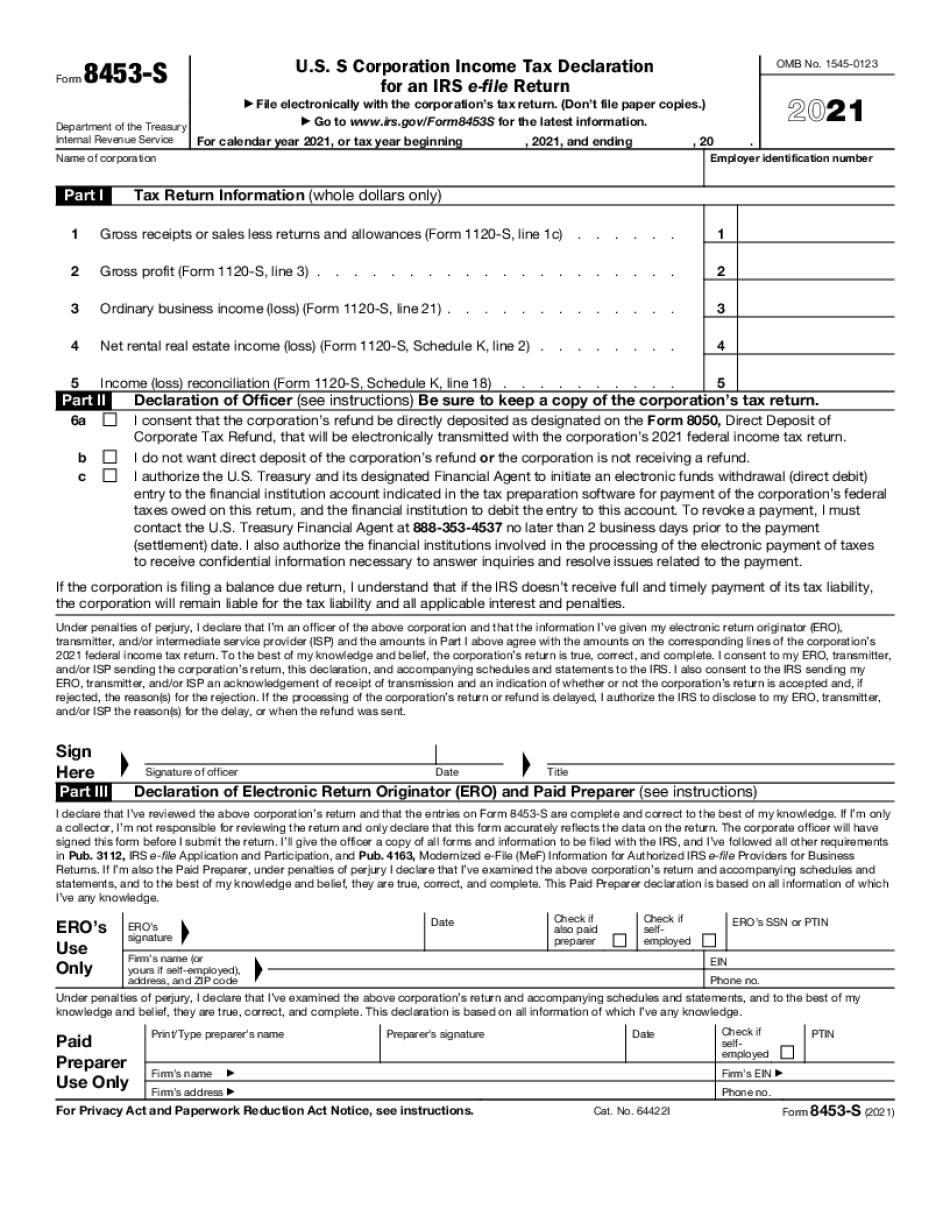

Video instructions and help with filling out and completing When Form 8453 S Withholding