A deduction is really important because when you take a deduction on your taxes, you're actually lowering your taxable income. This means you're saving on taxes today. Some of the more common deductions are the standard deduction that you may be able to take. There might also be itemized deductions like mortgage interest or real estate taxes, or contributing money to a charity. Just to give you an example to put this into context, if I made fifty thousand dollars a year and I contributed two thousand dollars to charity, I'm lowering my taxable income from fifty thousand down to forty-eight thousand. That's gonna save me money on taxes. Now, it's not a free benefit—I had to contribute money to do it—but that deduction is compensating me for part of that amount. So, what everybody watching this needs to do is to really review your tax situation to see if there are other deductions that you might be entitled to, but are not currently taking. I see that all the time when I'm reviewing someone's tax returns. There were deductions that they were eligible for, but they just didn't know about. As a result, they ended up missing out on that benefit. If you work with some tax development software or you work with an accountant, make sure you review all the possible deductions that you may be eligible for and take advantage of what you're entitled to. This will really minimize your tax burden.

Award-winning PDF software

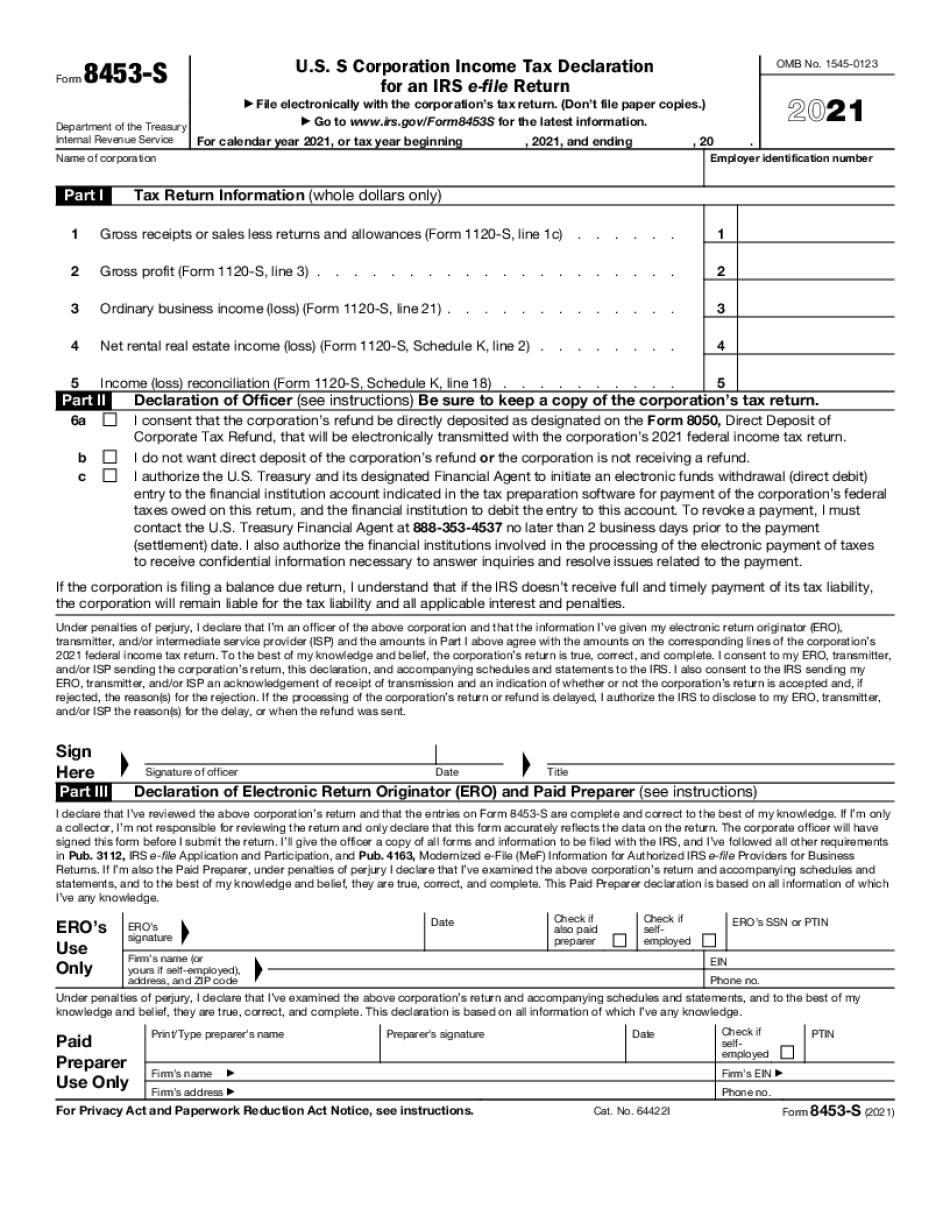

Video instructions and help with filling out and completing Where Form 8453 S Deductions