So, I heard a couple of people here say that you're either in the counseling industry or doing something health-related or professional services. But there are often times when the law will require businesses involved in certain activities, like healthcare or providing high-level professional services, to organize in a specific way. For example, if I wanted to start my own practice, I would have to organize as a PLLC (professional limited liability company) or a partnership, depending on the recognized form for that profession. It's important to keep in mind that different entity types have different tax and financial implications. I won't go into detail on that because it depends on your own personal financial situation and what makes the most sense for you. However, one important distinction to understand is between an LLC (limited liability company) or a pass-through entity and a corporation when it comes to taxation. Let's take this example: If you form an LLC and it starts making money, at the end of the year, the earnings will pass through to you as the owner and you will file taxes based on your share of the earnings. The LLC itself doesn't pay taxes. On the other hand, a corporation has to file a corporate tax return and pay taxes at the corporate level. As an owner or shareholder, if you receive a salary, bonus, or other value from the corporation, you'll have to report that as personal income and pay taxes on it, resulting in double taxation. That's why, from a tax standpoint, it's generally advantageous to organize as an LLC. There are some exceptions where certain corporations can receive pass-through treatment, but it's beyond the scope of what I want to cover today. When setting up your business, it's wise to consult with an accountant or someone knowledgeable...

Award-winning PDF software

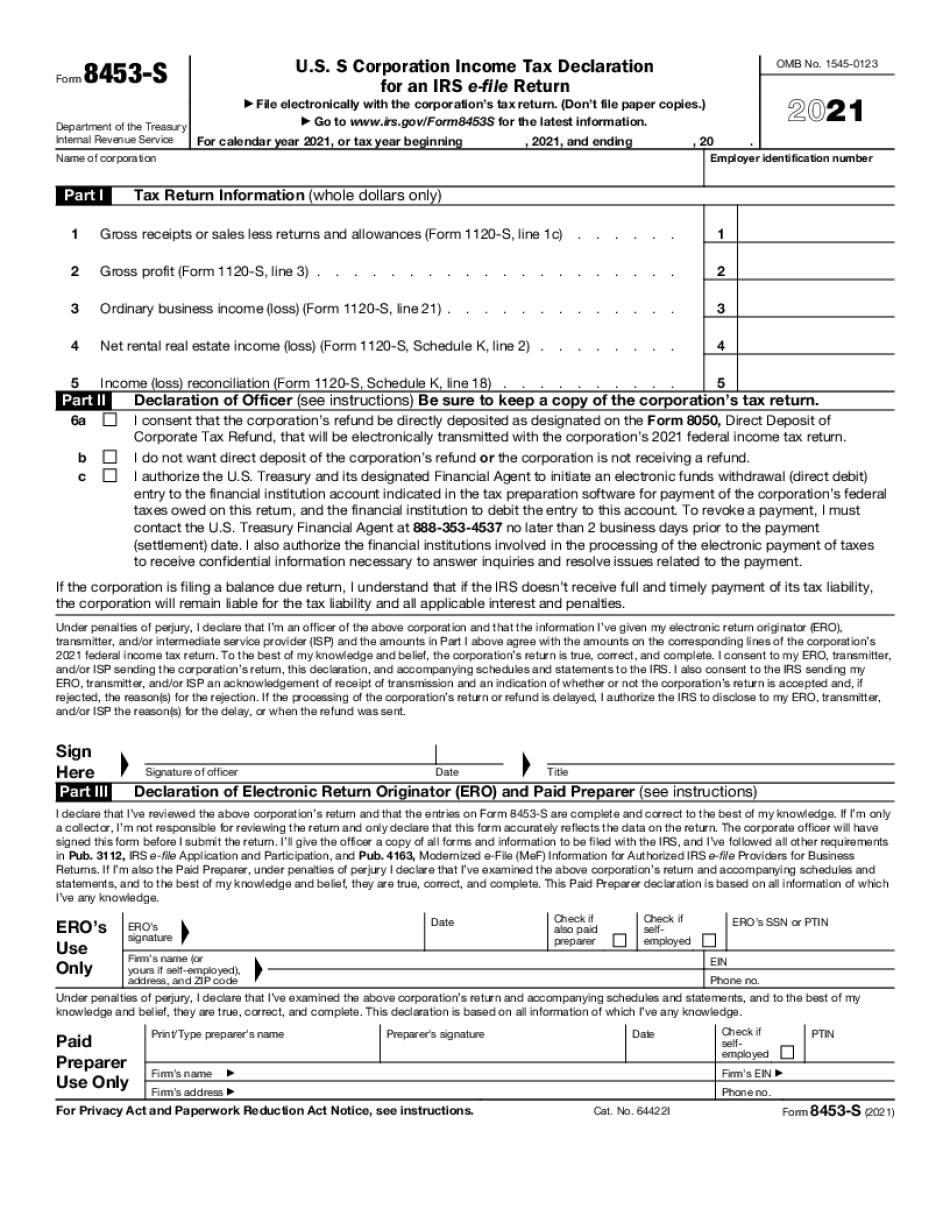

Video instructions and help with filling out and completing Where Form 8453 S Entities