All right, so now that we have our gross monthly salary, we are going to talk about deductions. Deductions are the things that are taken off of our paychecks to go towards certain things. In Canada, there are some deductions that we have to pay, one of them being the Canadian pension plan. I won't go into detail about every single deduction on the page, but there will be a section at the bottom that shows what each deduction is and how I arrived at the numbers. Another deduction you'll see is employment insurance, which are some of the main ones you would see. So, what does all this mean? It means that a percentage of your paycheck is going to go towards all of these deductions. Typically, for most people, they lose roughly about thirty to thirty-five percent of their paycheck towards these things. Let's go with 35 percent specifically. One thing we have to do, if you remember from calculating percentages, is that we can't take 35 per 10 percent as a number. We have to turn it into a decimal so that we can calculate with it. To turn 35 percent into a decimal, we divide it by the total of 100 percent. So, we get .35 as the decimal we want to use to figure out the percentage of a number. Now, if we go back to our gross monthly salary of $2,600, we're going to take that and multiply it by .35. We get $910. That is the deduction, and that is how much would come off our paycheck from this amount. We'll talk about that in the next video.

Award-winning PDF software

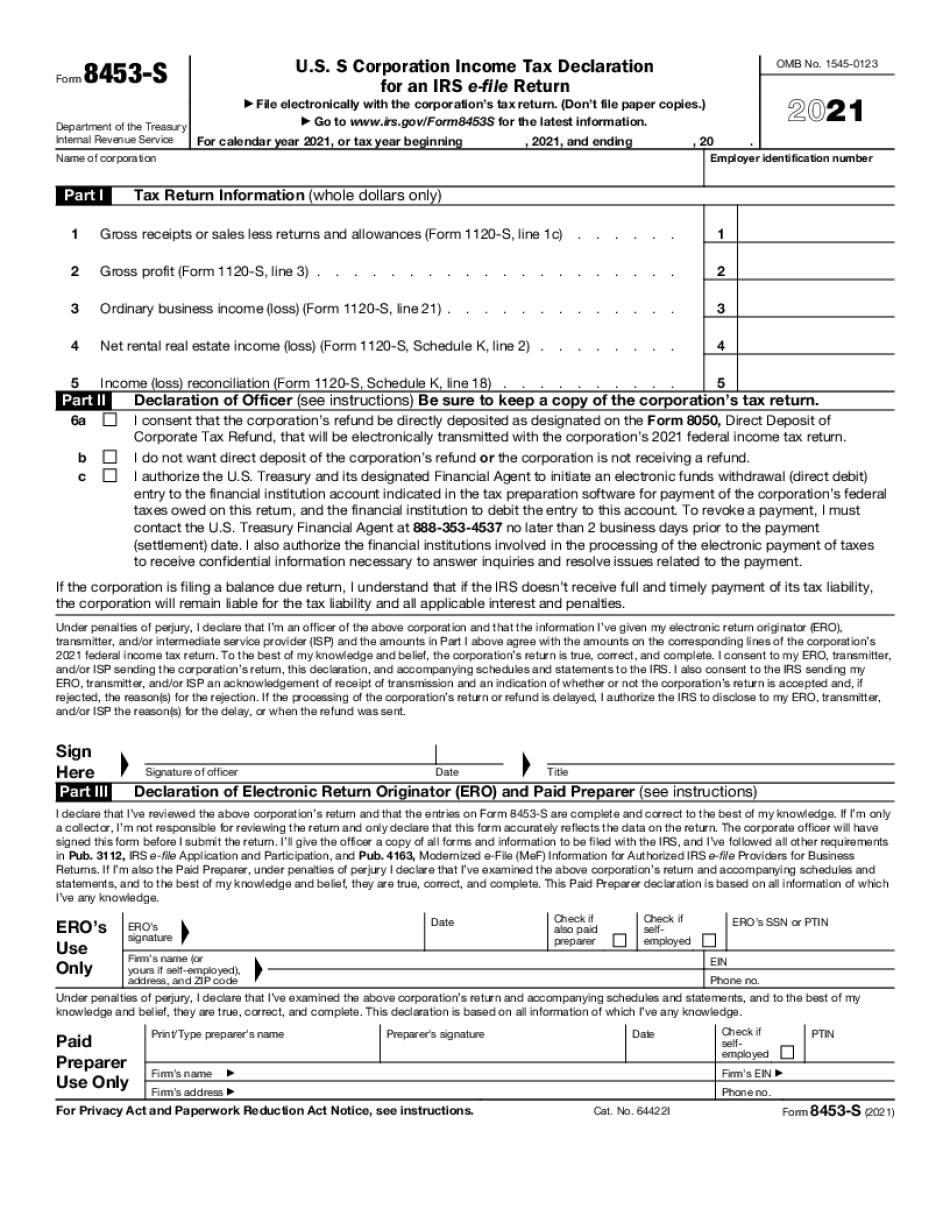

Video instructions and help with filling out and completing Why Form 8453 S Deductions