Award-winning PDF software

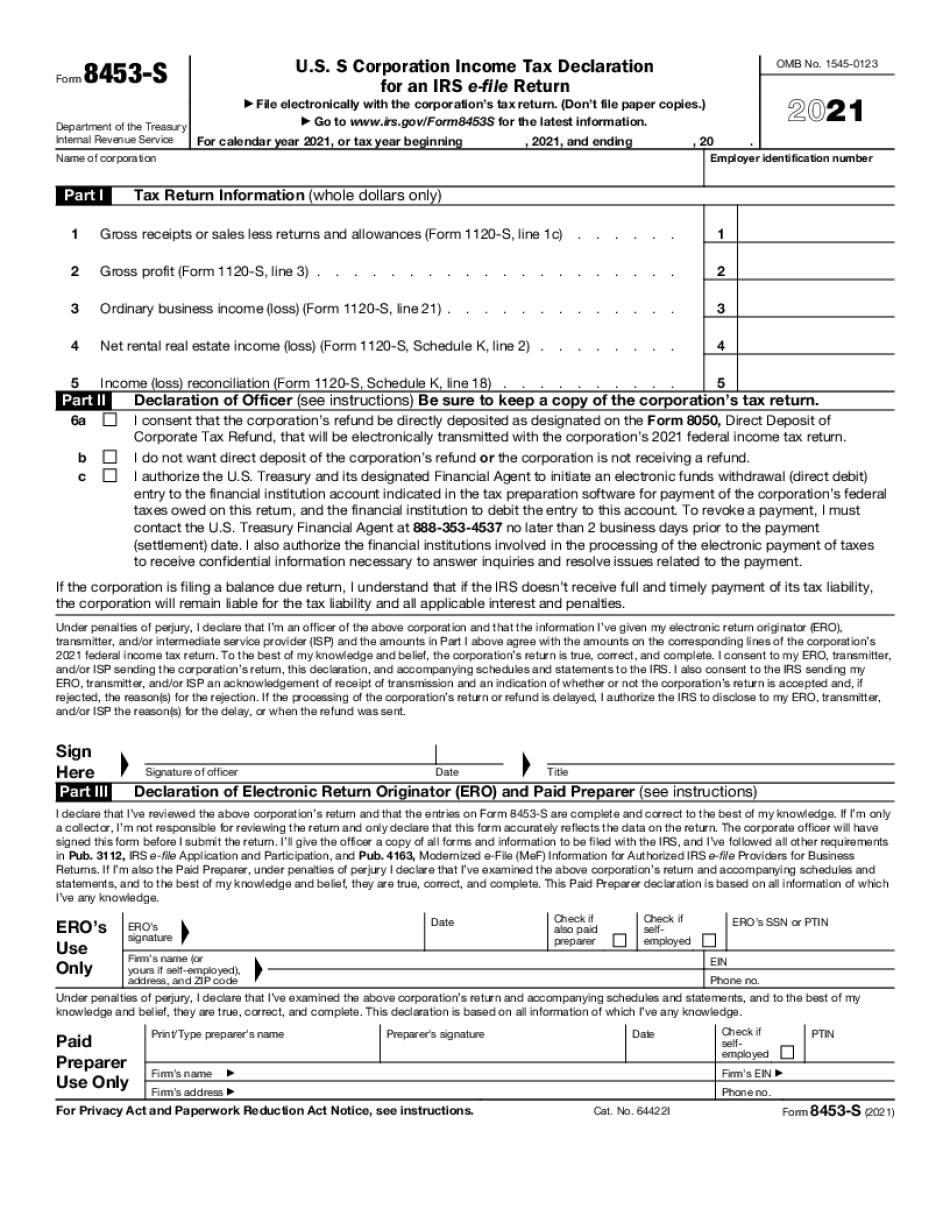

Us Income Tax Return For An S Corporation - Internal Revenue: What You Should Know

Brokers that receive your cash-settled ETFs must report them on Form 1099-B. Some dealers report your cash-settled ETFs on Form 1099-B. Learn about the reporting requirements you may encounter on Forms 1099-B This is a general outline, see the regulations section of the IRS website for detailed information on filing a Form 1099-B. Also see the Forms 1099-B Instructions and Regulations page for more information. 1093-B—Prohibited Transactions—Tax Reporting This is a general outline, see the regulations section of the IRS website for detailed information on filing a Form 1093-B. Also see the Forms 1093-B and 1093-SA Instructions and Regulations page for more information. We are happy to discuss what is included on a Form 1093-B. Please reach out to a Vanguard tax specialist for advice. 1099-K This is a general outline, see the regulations section of the IRS website for detailed information on filing a form 1099-K. Read the details and make sure that we understand them. The IRS will provide more detailed guidance with respect to Form 1099-K. 1099-MISC This is a general outline, see the regulations section of the IRS website for detailed information on filing a Form 1099-MISC. Read the details and confirm that we understand them. The IRS will provide more detailed guidance with respect to Form 1099-MISC. Forms The following forms are generally required to file a Form 1099-DIV, 1099-B, 1099-B/C, or 1099-MISC: 1099-DIV This form is generally filed by your broker-dealer for each sale of units of your Vanguard ETFs. This form contains the information you need to report a gain or loss on an income tax payment when the ETF unit price exceeds the cost of the ETFs. You must complete the form no later than February 15 of the year following the taxable income year for which you need to report that gain or loss. 1099-B You generally report this form on Form 1099-B-T at any time prior to the year you receive or owe a distribution.

Online choices aid you to prepare your doc management and strengthen the productivity of one's workflow. Observe the quick handbook to be able to carry out US Income Tax Return for an S Corporation - Internal Revenue, avoid problems and furnish it in a very well timed fashion:

How to accomplish a US Income Tax Return for an S Corporation - Internal Revenue internet:

- On the website along with the form, click on Start out Now and move towards editor.

- Use the clues to fill out the applicable fields.

- Include your personal information and facts and get in touch with knowledge.

- Make certain that you just enter right info and figures in applicable fields.

- Carefully look at the subject matter belonging to the sort in the process as grammar and spelling.

- Refer to support section should you have any queries or deal with our Guidance staff.

- Put an digital signature on your US Income Tax Return for an S Corporation - Internal Revenue when using the guidance of Indication Instrument.

- Once the form is finished, push Performed.

- Distribute the all set kind by means of email or fax, print it out or preserve in your device.

PDF editor lets you to definitely make variations on your US Income Tax Return for an S Corporation - Internal Revenue from any net connected product, personalize it in keeping with your requirements, signal it electronically and distribute in different approaches.