Award-winning PDF software

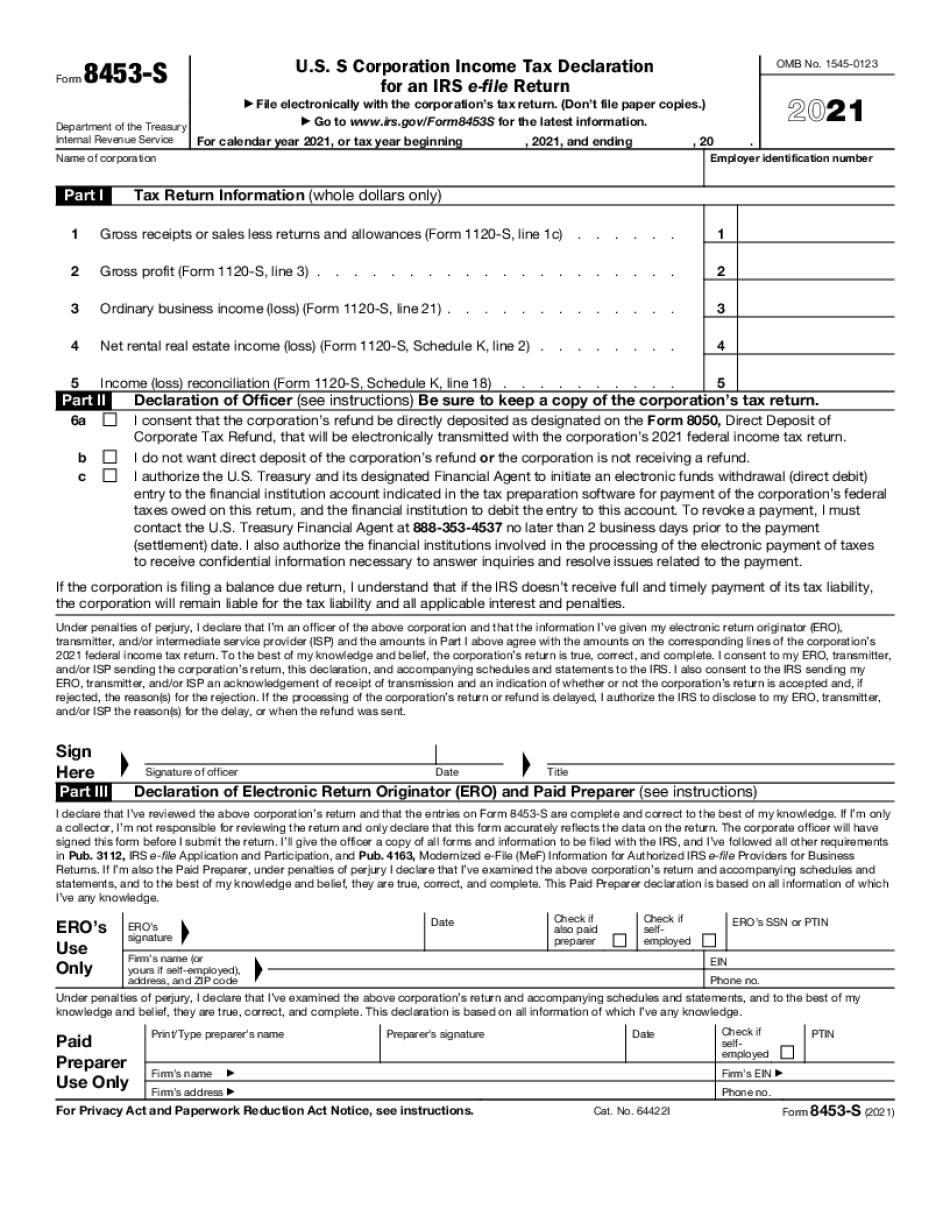

Daly City California online Form 8453-S: What You Should Know

Form 8039-PF, Trust Fund Profit & Loss Tax Returns, Apr 11, 2018-Form 8039-CP and Form 8039-PF, Trust Fund Profit & Loss Tax Returns, to make a tax-free loan (Form 4661) of up to 100,000 to a qualified organization to accomplish a qualified objective (such as strengthening the economy, educating the American people, increasing public safety or serving the public interest in the application of research, innovation or engineering skills or the application of technology and management of resources). The amount of these loans will not exceed the net proceeds from the sale of the principal property by the organization. Payments due by August 31. Non-U.S. person individuals, estates, trusts and similar entities not specified on the return may be eligible for a 1099-MISC tax-free form (Form 8854) if they have not fully utilized the loan proceeds (see Schedule H, line 21). The amount of payments due must be reduced to zero by the amount of the gross proceeds. The Department of Treasury Internal Revenue Service will not issue Form 8854 to individuals unless they are an authorized officer or employee of the corporation. Form 4668 -- U.S. Nonresident Alien Individual Income Tax Return, Form 4668.pdf — Form 4668 for Taxpayers not authorized to file a U.S. return on Form W-2 or Form 1040. Form 4668, U.S. Nonresident Alien Individual Income Tax Return for Nonresident Aliens Form 8453 — Electronic Return Note: Form 8453-TE is an electronic form. Click here to download. PDF version of the Form 8453-TE is available at This form can also be downloaded or viewed on your PC. Form 8453-TE, Electronic Return Go to for the latest information. Enter your name and mailing address as well as your SSN. Fill in the appropriate fields. If the amount of tax withheld from the payment amount is based on the gross income of the taxpayer, enter the gross income for that year in the second box entitled “Gross Income.” Enter your total personal income tax and employment tax income or deductions from prior years in the box labeled “Total.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Daly City California online Form 8453-S, keep away from glitches and furnish it inside a timely method:

How to complete a Daly City California online Form 8453-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Daly City California online Form 8453-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Daly City California online Form 8453-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.