Award-winning PDF software

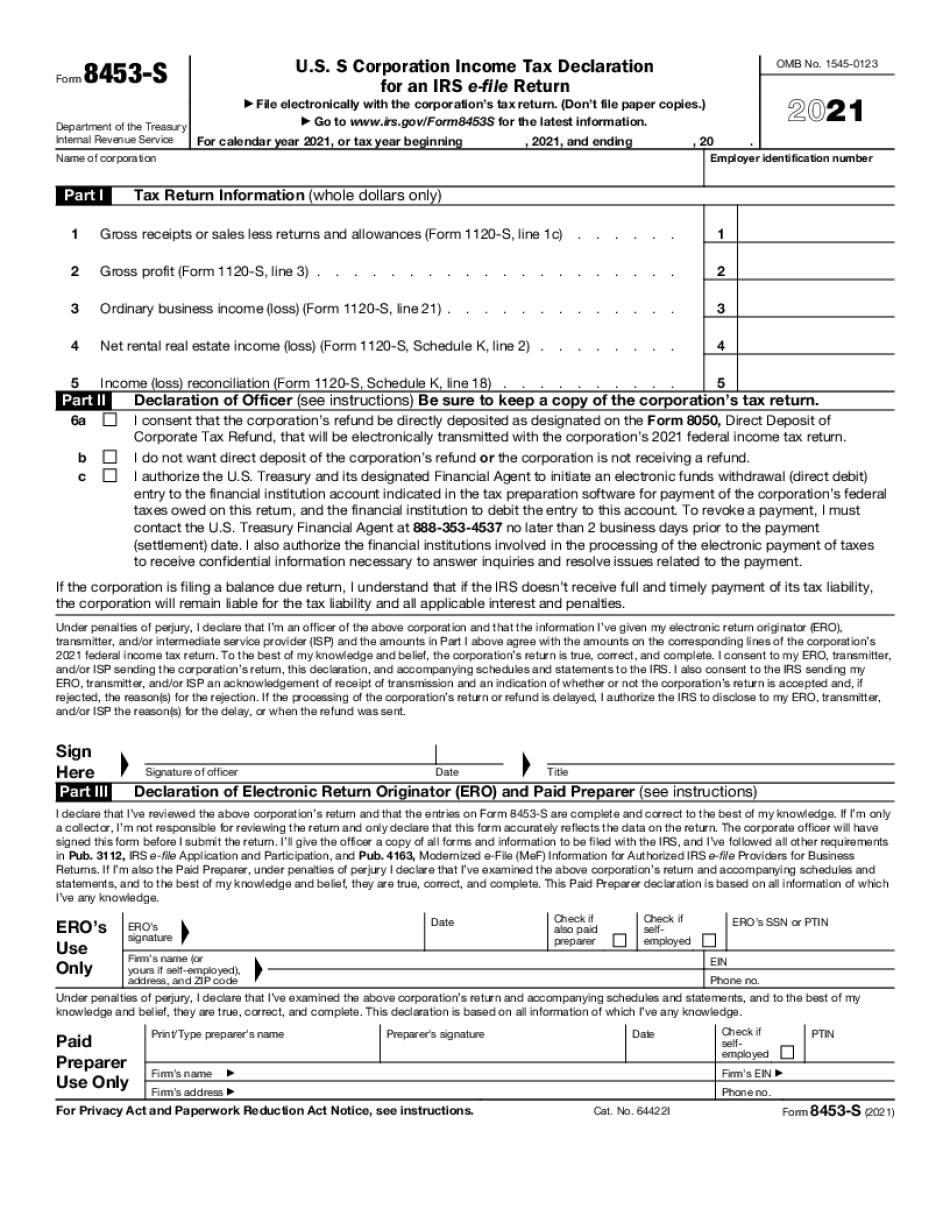

League City Texas Form 8453-S: What You Should Know

Floors For Living, we know that quality matters. Quality matters when you are building one of the largest floors in the United States. So we are pleased that you are here. We will do all we can in the way us, the owner, can to help you choose the best quality carpet or hardwood flooring for your new home or business. We offer our customers the convenience of ordering online through this site. If you have your flooring order ready to go when you arrive at our store, you won't need to pay us at the door. When you arrive, please let us know you were here. We want to help you choose the flooring that works best for your home. So stop by, ask us questions, and have a look around our store. We know the choice you make here will make your life easier. You'll see we offer our customers something to think about, too. You should select the flooring that offers you maximum durability and longevity. We offer our customers a level of service that rivals any in the industry. From the moment you receive your order, we want you to be fully satisfied. Our flooring is guaranteed, if not more. Whether you select hardwood, carpet, or tile, your floor will arrive to you in perfect condition. We want to give you the best experience as a flooring retailer, and we will do everything we can to deliver it. This website is available only in the United States at this time, but we also know that many of you out there outside the U.S. are probably also interested in getting flooring made specifically for your business. We'll let you know when we get your order in. The best is still to come. If you are an S Corporation or partnership, you will qualify for tax-exempt status under Section 501(C) (3). However, if you elect not to be treated as a Section 501(C) (3) entity, you would still have to pay certain taxes. This means, you will still need to file a U.S. income tax return. You must also pay federal and state taxes on your net earnings. S Corporations and partnerships may also qualify for tax-free retirement distributions. These distributions can be made to any individual or to any qualified tax-exempt organization. U.S. Individual Tax Returns are due within 1 year of the year in which you file. If you are a foreign corporation, your U.S.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete League City Texas Form 8453-S, keep away from glitches and furnish it inside a timely method:

How to complete a League City Texas Form 8453-S?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your League City Texas Form 8453-S aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your League City Texas Form 8453-S from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.